The municipal bond market is widely considered to be a safe-haven investment class. Since they are backed by tax revenue from state or local governments, muni bonds carry a relatively low risk of default compared to corporate bonds that rely on a company’s solvency. Investors also benefit from the tax-exempt status of these bonds, which increases their after-tax yields compared to many other types of bonds – including Treasury bonds.

Of course, this doesn’t mean that defaults never occur. The City of Detroit filed for Chapter 9 bankruptcy in July of 2013 following the long-term decline in its economy. More recently, Puerto Rico’s January 2016 default on some of its muni bonds illustrated that high-yield bonds in the space come with significant risks. The dramatic decline in the U.S. energy industry could also have an impact on muni bonds – particularly those tied to the industry’s revenue.

Municipal Utilities See Rising Risks

Municipal utilities have issued more than $30 billion of tax-exempt bonds to buy gas under long-term contracts, according to Bloomberg. The utilities use the proceeds to enter into gas contracts with financial institutions whereby they secure a steady flow of energy at a predictable price. The financial institutions invest the proceeds from the contract and repay the bond with natural gas through futures contracts that they enter into over time.

The problem is that natural gas prices have fallen more than 40% since the middle of last year, which has put pressure on the financial institutions backing those bonds. Some investors are concerned that the municipal utility debt may only be worth as much as the financial institution’s ability to make good on the contract. After all, there have been defaults before during the 2008 crisis when Lehman Brothers was unable to fulfill its end of the bargain.

Energy-Dependent State Revenues

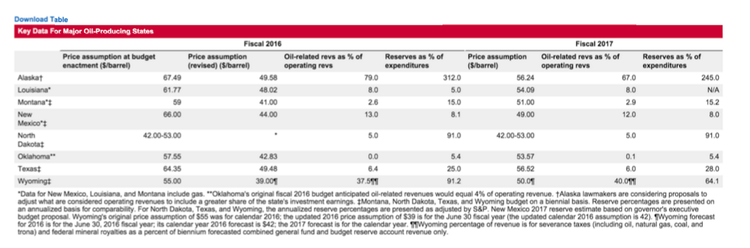

Many states have become dependent on energy revenue when it comes to balancing their state budgets, which puts them at risk when energy prices fall. Alaska, Louisiana and New Mexico are all at risk of having their credit ratings lowered, according to a report from Standard & Poor’s Ratings Service. These states may have been too aggressive in their assumptions about oil-related revenue during the boom and face acute financial pressures now during the bust.

Municipal bonds in these states could face slightly higher risks in the event of a downgrade, particularly in states that were a little too aggressive. For example, Alaska had a fiscal 2016 price assumption of $49.58 per barrel, according to S&P, while prices are currently hovering around $30 per barrel. Fiscal deficits probably won’t have a big impact on general obligation bonds, but certain revenue bonds could be negatively impacted.

Job growth in oil-producing states could also stagnate due to the energy slowdown, which could put pressure on state and municipality tax bases. For instance, Texas, North Dakota, Louisiana and Oklahoma are now lagging the rest of the nation in employment growth. This means that public assistance expenditures in states like Texas are running ahead of estimates, which could further compound budget issues moving forward.

The Bottom Line

The dramatic decline of crude oil and natural gas prices could have a modest impact on the municipal bond sector. Revenue bonds tied to utilities could begin to look a bit less attractive as the credit quality of financial institutions declines. Further, general obligation bonds could suffer from deteriorating credit ratings for states that were overly aggressive in their predictions for crude oil prices in fiscal 2016 and beyond.

It’s unlikely that these events would force any major defaults in the muni markets, but they could put downward pressure on prices and upward pressure on yields.